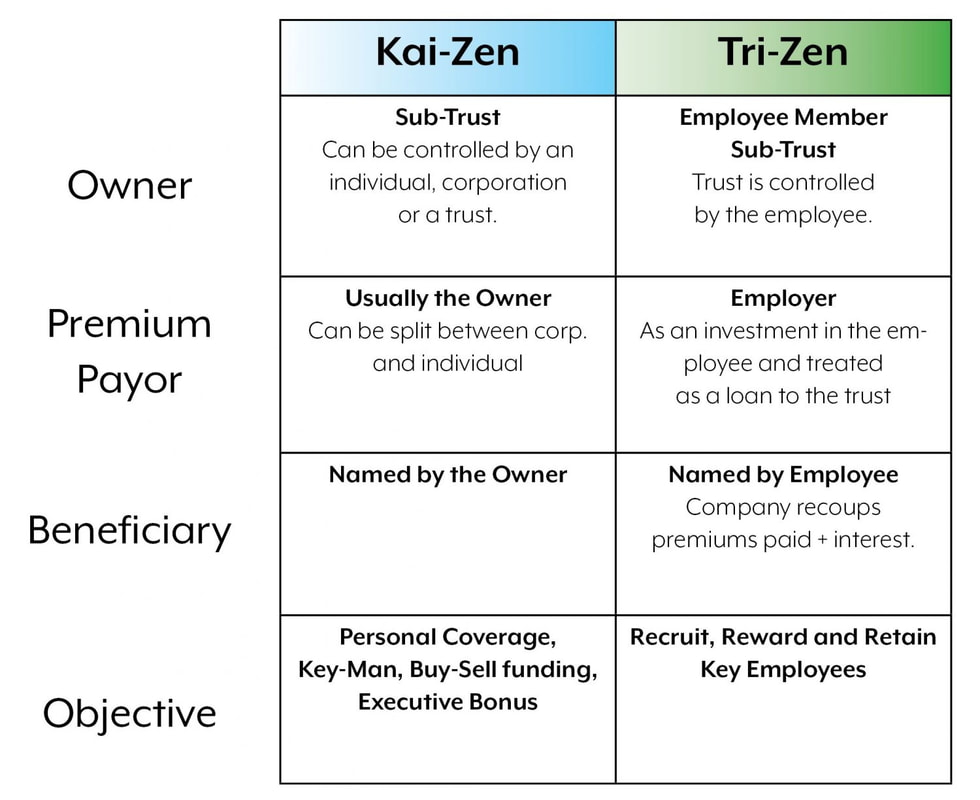

COMPARISON KAI-ZEN vs TRI-ZEN

- Kai-Zen and Tri-Zen both take the money employers are already paying and supercharges it for the benefit of the employee AS WELL AS the employer, ultimately resulting in an employee benefit plan that has substantial competitive advantages in recruiting and retaining key employees.

- Kai-Zen and Tri-Zen both add roughly 3 times more cash using financing in a way in which the owner need not qualify, sign or have to post any outside collateral for the loan.

- Tri-Zen and Kai-Zen for Companies can be eligible to offer Guaranteed Issue for the Company on an Individual Case by Case Basis. This means an Employee Not Eligible for Insurance Coverage Because of a Medical Condition Can still Benefit from the plan.

- Tri-Zen is used predominantly in the non-profit marketplace but can also be used in the larger C-corps and by publicly traded companies. Kai-Zen can be used almost everywhere else.

- Kai-Zen can also be used as key man, split dollar, 162 bonus, a buy-sell funding vehicle, etc. The contracts are structured as if there was no financing so the parameters for ownership, vesting, beneficiaries, taxation, etc. are customized and determined by what the client is trying to accomplish.

The only difference between the two is how they are structured (owner & premium payor).

Tri-Zen’s owner is the employee’s trust and the premium payor is the employer.