INDIVIDUALS

Due to limitations in the tax code regulating traditional Qualified Retirement Plans, these plans are typically insufficient to maintain an acceptable lifestyle. If you want to maintain or improve your lifestyle in retirement, you need a proactive strategy that puts more money toward protecting your future income without putting a drain on your current finances.

What is Kai-Zen?

- Kai-Zen is a Customized Strategy that uses a Unique Insurance and Bank Financed Leveraged Savings Plan Designed to reduce income tax exposure and help you acquire more supplemental retirement income. The Kai-Zen leveraged strategy are bank financed insurance premium payments which additionally includes insurance for the living benefits needed to protect you and your family.

- The Kai-Zen Leveraged Savings Account with Enhanced Income, gives the INDIVIDUAL CLIENT or COMPANY EMPLOYEE health benefits today (chronic illness, injury, terminal, chronic illness, etc.) as part of the retirement savings plan at no additional cost.

- The Kai-Zen plan has 3 times more leveraged cash, typically resulting in at least 60% x 100% more tax-free money depending on the clients objectives and circumstances, (some cases 76% x 100% ) for a supplemental retirement income, and more living benefit protections for today (chronic illness, injury, terminal, critical illness, etc.) as part of the plan.

- This bank leverage of 75% allows you to have these benefits sooner and for a longer period of time.

By using bank financing, the Kai-Zen strategy is designed to allow you to retain more of your own capital and realize benefits beyond your expectations while keeping contributions within your means. By bringing additional money to the table with the same rate of return we have the ability to potentially have more retirement income.

- Its unique fusion of bank financing and life insurance offers you more protection, and leveraged accelerated cash accumulation, to earn more for your retirement future than you could obtain without leverage and provides a legacy that can pay estate taxes.

This concept is not much different than financing a house – you use a mortgage to leverage the assets you have on hand to buy more house with less money as a down payment. Money is borrowed to buy more house, or with Kai-Zen, for more benefits and for more retirement income. Leveraging other peoples money to finance a business, real estate or an asset, such as an insurance policy is not a new idea.

- The Kai-Zen premium financed plan is a low-interest bank loan combined with a uniquely mathematically structured insurance plan.

- The insurance plan is designed to never lose principal, and has the capability for more cash accumulation and accelerated income performance, without the risk of losses due to declines in a market index. The Kai-Zen plan only participates in the upside potential of the market. Eliminating the possibility of loss will also significantly increase rate of return.

- The loan is secured solely by the insurance policies cash value, which means no loan underwriting for the client and the collateral for the loan obligation is built into the plan itself.

This Leveraged Retirement Savings Enhanced Tax-Free Income Plan is a Supplemental Non-Qualified Enhanced Tax-Free Income Plan, that has significantly MORE POTENTIAL EARNING POWER and BETTER TAX INCENTIVES for the client, than Deferred Money from QUALIFIED EMPLOYER RETIREMENT PLANS, including Employer Matching Contribution Plans and a Roth. Wealthy individuals have been using Leveraged Retirement Savings Plans as Personal Retirement Plans for decades, as dependable supplemental tax-free income.

The Kai-Zen Customized No Collateral Premium Financed Strategies, are an exceptional alternative for choosing to put less money into a Qualified Plan, such as 401 (K), Cash Balance, etc., and use that TAX-DEFERRED Money, for our Leveraged 3 x 1 Retirement Savings Plan with Enhanced TAX-FREE Income.

Less Deferred Money into a Qualified Retirement Plan for Living Better Tomorrow with a Premium Financed Retirement Savings Plan

Compare Kai-Zen to What You Could Afford Using Your Own Money

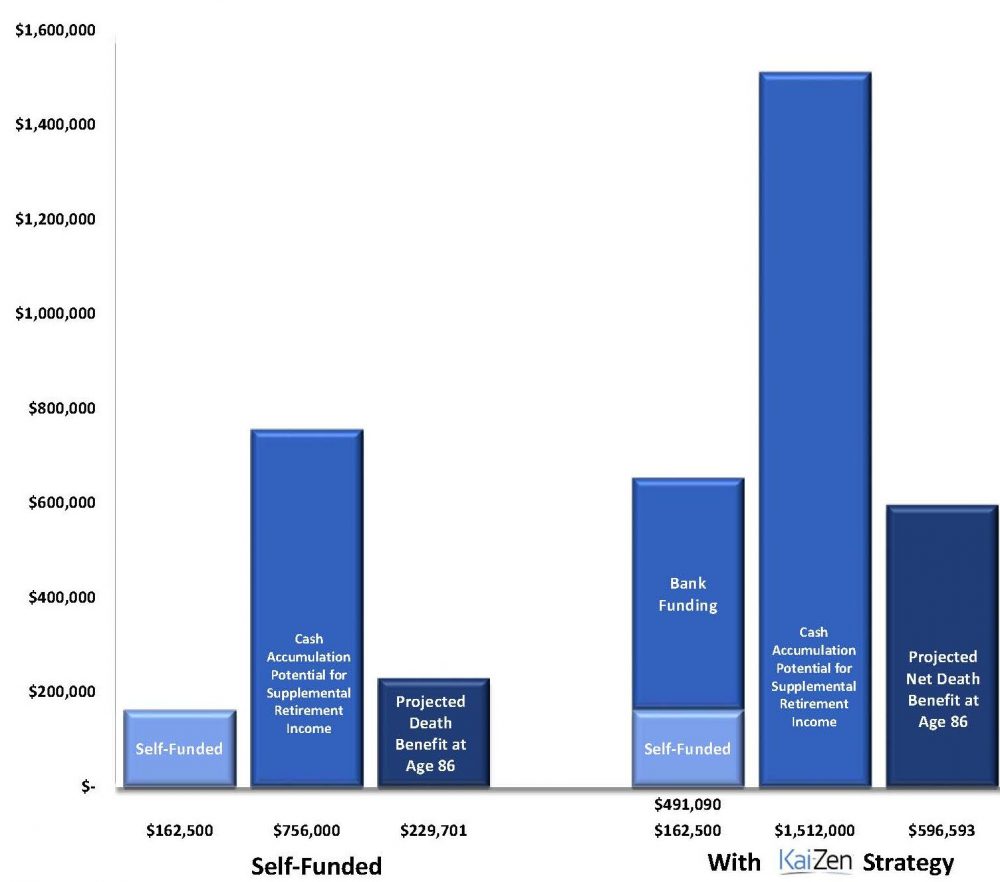

As you can see from the chart below, the addition of bank funding gives you new money at a 3:1 leveraged boost. This new money allows for the potential to significantly amplify the funds available to be used for client benefits, and for a supplemental enhanced retirement income.

EXAMPLE: SELF FUNDED VS. KAI-ZEN

* Kai-Zen is a registered trademark of NIW Company. Source NIW Company

HOW DOES THE SAVINGS USING SIMPLE MATH FOR AN IRA COMPARE? As an example, assume your regular IRA has $1 million in assets. Assume the effective tax rate is 40% as shown in item 10 for the 401(K) comparison below, and you have an investment strategy that doubles your investment every 10 years. After a decade, the regular IRA doubles in value to $2 million. At a 40% tax rate times $2 million a tax of $800,000 goes to the IRS, leaving your IRA investment with $1.2 million after taxes.

To see how you can start out with more money and outperform an Employer Matching Contribution Plan, Roth, Cash Balance, Defined Benefit or a 401 (K), read “RETIRE BETTER THAN YOU LIVE TODAY” and “ARE YOU CURRENTLY SAVING ENOUGH?” section under WHY CHOOSE US.

401(K) Comparison of 10 Important Considerations

Qualified Plan Alternatives Cannot Compete with Premium Financed Retirement Saving Plans for Earning Power

| Kai-Zen Premium Finance Design | VS | 401 (K) |

|---|---|---|

| 1. Contributions Deductible for Employer. Employee Contribution Taxable to Employee. | 1. Contributions Deductible for Employer. Tax Deferred for Employee. | |

| 2. Earnings Tax-Free. Average Plan Cost < 1% Plan only Participates in the Upside Potential of the Market. Plan Guaranteed Not to Lose Money from Market Loses. | 2. Cost for Required Plan Updates and Plan Administration Fees. Brokerage Dealer and Investment Management Fees. Transactional Fees some of which are imbedded. All Reduce Investment Retirement Savings. Market Volatility Risks. | |

| 3. Distributions Tax-Free. (Resembles a Roth IRA) | 3. Distributions Taxed as Ordinary Income. 37% Top Individual Rate. | |

| 4. Inherited Benefits Can Be Tax-Free to Family. (Not with Income During Life) | 4. Inherited Benefits Subject to Double Tax Inherited Benefits Can Receive Step-Up Basis at Death if Included in Taxable Assets. | |

| 5. No ERISA unless Split-Dollar. (Limited to Written Plan Requirement) | 5. Full ERISA Compliance. Penalties. Discrimination in Favor of Highly Compensated. Contribution Limited. Distribution Limits & Requirements. Annual Tax Return & Reporting Required. Written Plan Requirements Must Be Updated – Costs. | |

| 6. Participant Receives Up To 3 to 1 * Contribution Match on the Entire Amount. Funded By Financing. | 6. Employee May Receive 1 to 1 Limited Contribution Match on Part of the Entire Amount. Funded By Employer to a Limit. |

| 7. Excess Supplement for KEY EMPLOYEES EXCEEDS 401 (K) NOT LIMITED BY ANY CAP. | 7. Contributions Limited By 401(K) Cap. | |

| 8. Limited Liquidity and Access Restrictions. (Bank Loan Must Be Repaid First) Better Suited for Long Term Retirement Saving Growth. Guarantee of No Loss from Market Down Swings. | 8. Limited Liquidity as per IRS Statutes. Substantial Tax to Access Net Proceeds. | |

| 9. No Excess Earnings Limitations. No Payroll Deductions. No FICA Expenses. No Contribution or Benefit Limits. | 9. Enforced IRS Penalties on Limitations. Age Requirements to access Funds. | |

| 10. Earnings from 3:1 Contribution Match, permit Tax-Free Distributions from Account Balance. Below see Bar Graph Comparison. | 10. Earnings Fully Taxable. Tax Reduces the Amount Invested. Part of the Earnings From the Investment May Qualify For Long Term Capital Gains Rates. Max. 23.8%. The rest is Ordinary Income. Rate Up to 40.8% on the rest. (37% + 3.8% Net Investment Income Tax) |

California Employers without a Qualified Retirement Savings Plan are now required to either enroll their workers in CalSavers or provide a Qualified Retirement Plan through the private market.

- More than 100 employees: Sept. 30, 2020

- More than 50 employees: June 30, 2021

- Five or more employees: June 30, 2022

- Plan Two (Kai-Zen) is an excellent alternative to put less money into a qualified plan and benefit from the potential for more savings that is tax-free on distribution that the premium financed design offers clients. California Clients eligible for Kai-Zen may supplement a qualified plan with Kai-Zen, or are Business Owners who have Opted-Out of CalSavers because they have less than 5 employees, and for Partnerships or other Business Entities with only Managing Partners.

- The Tax-Free Kai-Zen Customized No Collateral Bank Insurance Premium Financing Strategy, is an EXCELLENT OPTION for an INDIVIDUAL CLIENT in addition to CalSavers, or their current Qualified Plans, for either a Supplemental Enhanced Tax-Free Income or as a Leveraged Savings Retirement Plan with Enhanced Tax-Free Income.

- OUT OF STATE BUSINESS OWNER CLIENTS typically use the Kai-Zen No Collateral Customized Bank Financing Strategy for a Primary “Life Insurance Retirement Savings Plan,” with up to an unlimited amount of Eligible Employees, or as an Individual Client, for either a Supplemental Enhanced Tax-Free Income or as a Retirement Leveraged Savings Plan with an Enhanced Tax-Free Income.