RETIRE BETTER THAN YOU LIVE TODAY

Cayman Capital, Inc. offers Stock Market and Managed Portfolio Investment Choices from various prestigious market makers such as Goldman Sachs, RBC etc.

We also offer Managed Buffered Stock Market Portfolios and Insurance strategies that can guarantee 100% protection from loss of principal.

We offer Dividend Portfolios, Fixed Income, Growth and Stable Value Portfolios, Tactical Rotation, Socially Responsible and Contrarian Investment Portfolios, Energy Sector, Precious Metals, Technology and Duel Directional Portfolios. See Portfolio Safety & Equity Investments under the Heading ”STRATEGIES.” We also offer Leveraged Savings Plans underwritten by major insurance carriers, where a Bank guarantees the Insurance Premium Payments and the client may make Tax-Free withdrawals.

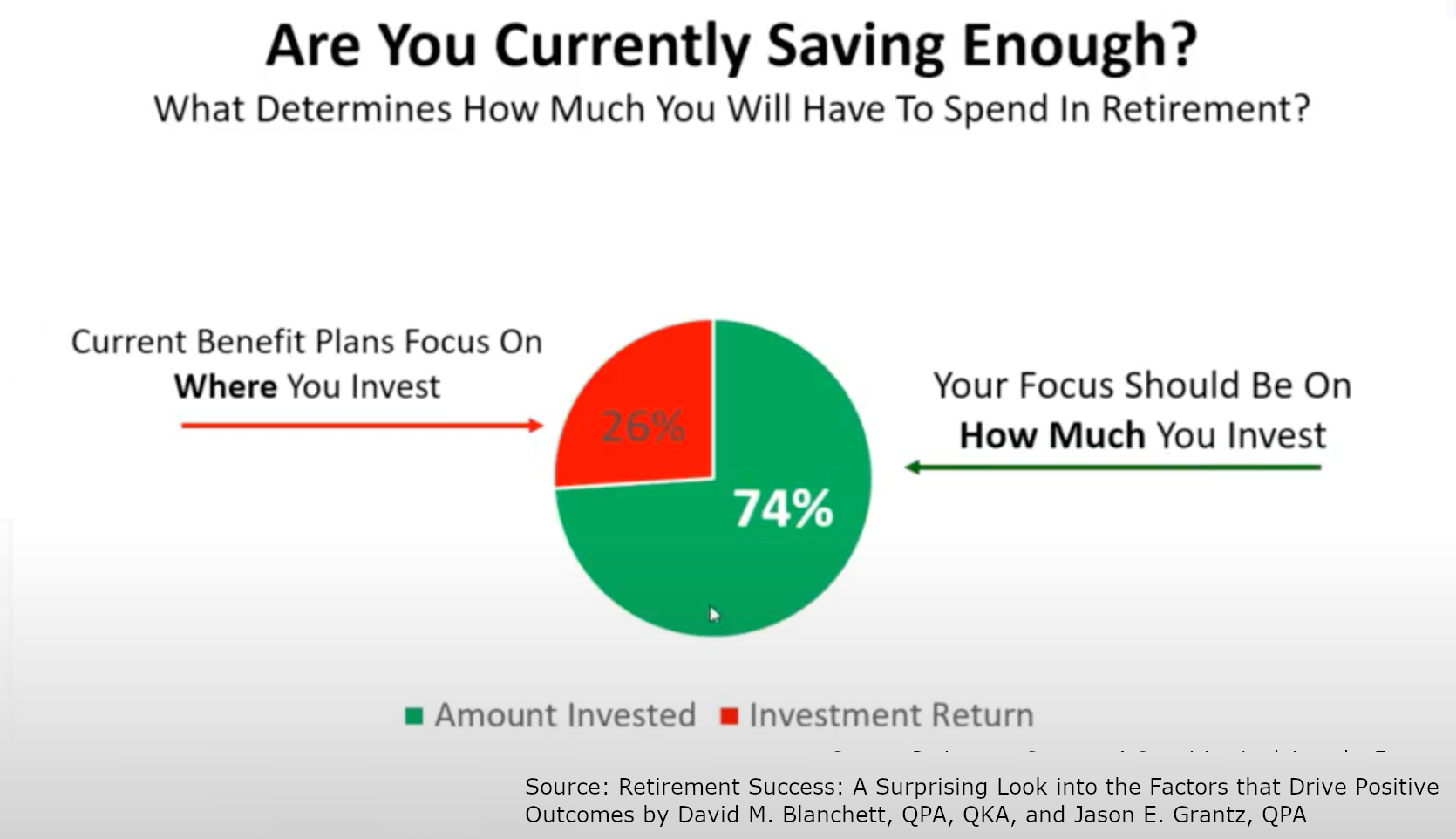

See ”ARE YOU CURRENTLY SAVING ENOUGH?” pie chart below.

LEVERAGED SAVINGS PLANS PERMIT TAX-FREE INCOME STRATEGIES FOR A MAXIMIZED SUPPLEMENTAL INCOME OR A MAXIMIZED RETIREMENT INCOME ADDITION TO YOUR QUALIFIED PLAN:

Many of our clients choose to have bank funded leveraged savings accounts for tax-free maximized income, as a favored option for a percentage of their portfolio assets. Leveraged Savings Plans have unique tax advantages and can have remarkable rates of return. Recognize a 300% better return than a Roth. This is not a new concept.

Eligible individuals have been using Bank Guaranteed Leveraged Savings Plans for a Tax-Free Lifetime Maximized Income Stream for decades.

THIS IS HOW IT WORKS

The bank will loan money to pay insurance premiums with either a No-Collateral or Collateralized design using the policy itself as collateral, usually for a few years, or until the cash value of the policy equals the loan amount. Cash value life insurance is an incredibly reliable asset that all major banks will on a regular basis invest a percentage of their own money.

INSURANCE IS ONE OF THE WORLD’S SAFEST ASSETS BUT ISN’T LEVERAGE RISKY?

Indexed life insurance. This asset is guaranteed not to lose principal. This is one reason why banks can loan money at their best preferred rate (Tier 1) for insurance premiums to pay for leverage. Please click on the following article written by two Tax and Estate Planning Attorneys. Insurance-The-Powerful-And-Despised-Tax-Shelter.pdf

Leverage is only as good as the asset being leveraged. Can Stocks and Real Estate claim to be guaranteed to not go down in value ? Leveraging stocks or real estate can be devastating. Cash value life insurance has reliably paid dividends since before the civil war. Cash value life insurance can deliver amplified earnings for Tax-Free future distribution by maximizing the cash value with leverage that has security. We use some of the financial worlds safest tools to work for you with out our hybrid policies. Only a Bond or CD can compare in Safety and Predictability. However, unlike bonds, CD’s or your 401 (k) money can be available when you need it.

A 401K with an employer matching plan is using leverage. The mortgage on your house is a routine and traditionally accepted way of using leverage to purchase a bigger home.

The client is borrowing other peoples money from the bank at a lower rate and then using it to earn a higher rate. (This is not the case when you borrow money from the bank for your mortgage) This arbitrage is characteristic of a well designed premium financed policy.

Similarly, there is a guarantee of no loss of principal and the insurance premiums will typically increase your retirement savings over time, by at least three times more money, than if you had just used your own money to pay the premiums.

Therefore, there is considerably more money available for retirement or as supplemental income from a savings plan that offers the premium finance strategy. More money that can allow for a better future lifestyle. Wealthy individuals and successful business entrepreneurs have been using other peoples money in this way for personal and business wealth management for decades to become prosperous.

With No Collateral Plans the Client can be totally protected from all risks associated with borrowing.

The type of Tax-Free Income Plan best for the client still will depend on the clients individual circumstances and objectives. Cayman Capital will make recommendations to help you choose the best customized plan for your present and future needs.

The Significantly Increased Cash Value of the Premium Financed Savings Account Guarantees the Bank Loans for the Insurance Premiums so No Collateral is needed. The Savings Account can therefore Provide a Future Larger Reliable Tax-Free Income Stream.

The bank depending on the choice of strategies, is either paid back by the cash value or a death benefit. In either case because of premiums being financed by the bank, there is a substantial multiplication of the amount cash in the saving account which can either be tax-free income or can continue to be maximized.

After the bank is paid back, because of the initial premium financing and continuing financing, there is still a very substantial amount of cash value in the savings account for either continued tax-free income, or as cash for a larger legacy to the beneficiary.

Tax-Free Income Plan One for eligible individuals and business entitles, is a current state-of-the art premium finance offering which also combines benefits of an innovative highly advanced design.

Plan One is an Index Universal Life Insurance Product, that may also use a Whole Life Insurance Product, providing Extra Safety and Dependability for the Greater Cash Value Accumulation, when indicated by the clients circumstances and market conditions.

With Tax-Free Income Plan One the Bank may fund the Premiums for the life of the policy. Bank and Policy Costs can be eliminated or neutralized.

With the Kai-Zen IUL No-Collateral design the client is protected from all risks associated with borrowing. How does a leveraged Indexed Universal Life Insurance (IUL) like Kai-Zen Benefit From the Present High Interest Inflationary Environment. Using the Kai-Zen IUL as an example please see this brief 2-3 minute video: https://www.youtube.com/watch?v=Ef-TBudC8qY

Plan Two (Kai- Zen) No Collateral Designs will typically receive a minimum future return of 60%-100%. Future returns can also be significantly greater as the design depends on the clients individual particulars. The Bank will contribute funding Premiums for the policy for 15 years.

Tax-Free Income Plan Three are the Collateralized Designs and will typically return 200%-300%. The Bank will fund the Premiums for the policy usually for 7 -10 years.

Plan Two and Plan Three are excellent choices depending on the clients circumstances and similar Plans are available from thousands of financial and wealth management firms. Our premier plan “Tax-Free Income Strategy Plan One” is a unique proprietary design that has been offered to eligible individuals for the past 10 years and is selectively available to wealth management firms.

HOW IT WORKS CONTINUED:

The banks we work with consider their premium financing loans to be “Tier One Loans” which means the loan rate is a qualified preferred rate defined as the lowest and best possible interest rate available.

Three typically will return 200%-300%. The Bank will typically fund the Premiums for the policy for 7-10 years.

THE BANK CAN ALSO LEVERAGE THE CASH VALUE OF THE POLICY INSTEAD OF FINANCING THE PREMIUM. DEPENDING ON CLIENTS CIRCUMSTANCES AND TOTAL NET WORTH THIS COULD BE A BETTER CHOICE IN THE HIGHER INTEREST INFLATIONARY ENVIRONMENT WE HAVE TODAY. LET CAYMAN CAPITAL SHOW YOU WHAT WE CAN DO FOR YOU WITH A FREE CONSULTATION

HOW PREMIUM FINANCING WORKS CONTINUED:

The banks we work with consider their premium financing loans to be “Tier One Loans” which means the loan rate is a qualified preferred rate defined as the lowest and best possible interest rate available.

- The banks we work with consider their premium financing loans to be “Tier One Loans” which means the loan rate is a qualified preferred rate defined as the lowest and best possible interest rate available.

- The bank is able to offer very low interest rates during the duration of the note as the insurance policy is a more secure asset to the lender than a 15 year mortgage. The housing market can have corrections that plummet property values.

The bank is writing the check to the insurance carrier. The client never sees the check. Neither Corporate nor Personal Guarantees are normally required.

- If the Client Choses to Pay a Portion of the Interest on the Bank Loan this will Significantly Increase Income and the Legacy. Depending on the client’s objectives and individual circumstances the INTEREST for PREMIUM FINANCING can a deductible business expense.

Premium Financed Insurance with Bank Guaranteed Savings Plans are acknowledged as one of the Best and Most Tax-Efficient Ways to Save for Retirement.

Protecting your income and savings with premium financed insurance can allow you to maintain your current lifestyle through retirement. Your retirement will cost an average of 6 times more than your house. Do you have enough saved?

- Premium Financing applies to many different circumstances. Good marketing motivates most of us to focus our retirement accounts primarily with an asset management approach.

However, studies include the prestigious American Society of Pension Professionals & Actuaries, and they have established that 74% of successful retirement accounts are due to starting out with more money, and only 26% are successful due to a rate of return earned from asset management. Would you prefer to earn 10% on $100,000 or 5% on $400,000?

If you currently earn $250,000 per year you will need around $6,500,00 saved for retirement to maintain your current lifestyle.

Therefore, starting out with more money increases your chances of success by 3 x 1. Premium Financed Leveraged Savings Accounts typically will deliver at least 3 times more cash in your account. Click link for research results American Society of Pension Professionals & Actuaries ASPPA Journal pdf

Premium Financing means you will be initially starting out with more money and maintaining more money in your account. This is so you can potentially also end up with more money as income for a better retirement lifestyle.

Another very simple way of saying this is that bringing additional money to the table with the same acceptable rate of return will result in having more money. Having more money to take advantage of in your account will maximize your income stream.

- For instance, you are using leveraging when you have a mortgage from the bank on the house, so you could buy a better house with less money as a down payment. The mortgage company requires that you take out insurance so there is a guarantee they will get paid back.

- In this case the guarantee to pay the bank back for financing your account is an insurance policy, and you can choose not to pay any monthly interest payments as the bank is making the payments for your monthly insurance premiums, and you do not have to make any payments toward the principal.

- Keep the use of your own money and its return.

- Keep Cash Flow for New Opportunities.

- Money is leveraged without the following risks. This unique insurance design has a Zero floor that guarantees protection against any loss of principal or any loses from the stock market. This policy only participates in the upside potential of the market. Eliminating the possibility of loss also significantly increases rate of return.

- The client benefits from an enhanced tax-free future income based on the cash value of the insurance policy which is typically increased 200%-300% with the Collateralized design.

- The death benefit can pay back the loan, and is an increasing amount to cover the interest portion of the loan, and is always more than the loan. Net of the loan we typically see a significant legacy for the beneficiary.

- The mathematical expressions designed for the policy’s’ compounding strategy of the cash value, is only one of the arbitrages behind correctly designed premium financing.

- The cash value in the insurance policy compounds faster than the loan rate, and because of this arbitrage, collateral is released in only a few years, when the cash value of the policy is the same as the collateral. This is called the crossover. The crossover is different for each person. Until there is the crossover the client is required to pledge collateral.

- “TAX-FREE INCOME STRATEGY THREE” covers this in more detail and reviews the advantages of a premium finance design with a more traditional approach that REQUIRES COLLATERAL.

- “TAX-FREE INCOME STRATEGY PLAN ONE & PLAN TWO” examines the Benefits of Hybrid Financing with NO COLLATERAL and NO PERSONAL REQUIRED Designs. Also PLEASE REVIEW No Collateral Option with PLAN THREE. Cayman Capital will make recommendations to help you choose the best plan for your circumstances and individualized wealth management needs.

- Click Here for a Sample Comparison of the 401 (K) vs Premium Financed Retirement Savings Plan.

- Consider the Retirement Leveraged Savings Plan Alternatives Before Max Funding Your Qualified Plans.

- DON’T LET YOUR QUALIFIED PLAN BECOME A TAX BURDEN.

- All Qualified Plans are Tax-Deferred Taxable Income. If you have a Self-Directed Qualified Plan consider Dr. Noss Professional Tax Expertise and Experience as an Investment Advisor who can Proficiently Optimize your Tax-Deferred Qualified Plan.

- Please also consider creating your own Secondary Personal Pension Plan as an Optimized and Leveraged Supplemental Retirement Account that you can control and that allows tax-free distributions and has no IRS funding limitations.

- Consider the ancient Chinese Proverb …..The best time to plant a tree was 20 years go. The second best time is now.

- Serving Clients all over the United States by offering virtual meetings.

- Compare a courtesy financial services premium finance designed illustration for yourself or your company, and see benefits significantly better than employee stock options, RSU’s, or even bonuses, which are taxed at 22%.

- Read Key Person Retention and Recruitment Benefits under “TAX-FREE INCOME STRATEGIES PLAN ONE and PLAN TWO and PLAN THREE.” PLAN THREE CAN ALSO OFFER THE EMPLOYER & EMPLOYEES THE BENEFITS OF PLAN TWO.

- PLAN ONE CAN OFFER THE SAME KEY PERSON RETENTION BENEFITS OF PLANS TWO & THREE.

- HOWEVER, PLAN ONE OFFERS ELIGIBLE EMPLOYERS A SIGNIFICANT ADDITIONAL INCOME ADVANTAGE TO THE EMPLOYER.

- Also see if your present qualified retirement plan is eligible for a Qualified Leveraged Strategy.

- Consider taking advantage of the free evaluation and free virtual consultation offered.