BUILDING A BETTER WAY TO YOUR FUTURE LIFESTYLE

” I am not so much concerned with the return on capital as I am with the return of capital. ” -Will Rogers

GENERAL OVERVIEW

Cayman Capital, Inc. is an independent investment, financial services and tax advisory company, specializing as a financial advisor in retirement income tax planning strategies and financial services strategies, that will enable you to retire better than you live today. Cayman Capital Inc. is registered as an investment advisor with the State of California.

The license to practice as an Enrolled Agent is the highest credential issued by the IRS for competence in Federal Taxation. Dr. Noss is licensed by the IRS as an Enrolled Agent and the managing principal of Retire Better Strategies, PC. Dr. Noss is also the CEO of Cayman Capital, Inc.

Dr. Noss is a Financial Services Tax Consultant. He specializes in the expert use of financial services for maximizing retirement or supplemental income potentially without the tax, and tax strategies for deferral of capital gains. Tax planning that also includes the proper use of financial services is a very effective taxpayer weapon that can also minimize taxes to zero. Discover New, and Perfectly Legal, Little Known Strategies for the Self-Employed in the IRS code. https://esttps://itep.org/55-profitable-corporations-zero-corporate-tax/

Many financial services and investment advisory companies and insurance agencies advertise various generalized tax benefits from purchasing their generic products. However, they cannot individualize that product for the most appropriate specific tax benefits needed for that particular context, and cannot make public or advertise as a tax professional authorized to give tax advice without certifications or formal training in taxation and taxation compliance. Therefore, almost all will have a disclaimer stating “consult your tax professional.” Tax mistakes concerning financial services products may result in loss of all tax benefits, and incur IRS fines, interest and penalties.

IRS individualized and business tax planning that integrates the proper use of Financial Services has many unique tax benefits, but also requires strict adherence and continuing compliance to many tax rules. This is a specialized skill that makes our services unique.

92% of High Net Worth, Ultra High Net Worth & Family Office Investors Expect Expert Tax Planning from their Wealth Manager. Only 25% Say they receive it. * https://funds.eatonvance.com/after-tax-advisor.php

Dr. Noss also represents clients at all levels of the IRS. Enrolled Agents Only Specialize in Taxation.

Dr. Noss, CEO, is empowered by the United States Department of the Treasury and federally authorized as an Enrolled Agent with unlimited rights to practice before the IRS concerning all tax matters, and to especially Advocate for Individual Taxpayers including Business Entities, Tax Shelters, Retirement Plan Actions, Installment Agreements, Back Taxes, etc. that have received deficiency notices or other adverse notices, or who are being audited and need Representation to Oppose an Unfavorable IRS Determination.

……………………..SCHEDULE YOUR FREE INITIAL CONSULTATION OR FREE VIRTUAL CONFERENCE TODAY………………………

Retire Better Sooner Strategies, PC offers retirement and supplemental income solutions for individuals and business entities, including 401 (K) qualified and non-qualified planning, key person retention and recruitment strategies, and other financial planning choices that will build net worth with less tax.

CUSTOMIZED WEALTH MANAGEMENT & RETIREMENT STRATEGIES THAT WILL GIVE YOU A GREATER INCOME INSTEAD OF A GREATER INCOME TAX.

Specialized expertise from integrating customized retirement plans and supplemental tax compliant enhanced income designs, can maximize savings with conservative leverage potentially with no tax, while protecting principal.

This is also what Makes us Unique as an Investment, Financial Services, Retirement Planning and Tax Advisory.

When there is considerable value and significant tax advantages for the clients’ particular individual or business circumstances recommendations may include a personalized custom financial services component.

“It’s important that CPA’s remain the trusted advisors and preferred providers of financial and advisory services to consumers everywhere” – Denise Fromming, CalCPA President & CEO, California CPA December 2021 Issue

Our firm may recommend participating with a designated CPA /Tax Attorney or Estate Planning Attorney or other attorney with specialized knowledge, or with an Attorney or CPA of your own choosing, when a collaborative approach is appropriate when a financial services component may present a significant tax advantage to implement a successful plan or for revision of an existing plan.

Participating with an attorney may be recommended as some advanced complicated tax-reduction strategies with Qualified or Non-Qualified Plans are dependent on maintaining proficiency in different areas of specialized legal expertise for certain industries and for other purposes, such as complex real estate transactions, advanced estate planning or for a special needs trust.

We also offer Qualified Leveraged Strategies (QLS) for Charitable Endowments or Estate Planning for clients with Large Qualified Retirement Plans.

- Cayman Capital offers cutting-edge lower cost Qualified Plan choices for retirement income. COMPARE and see if you can DECREASE EXPENSIVE 401(K) costs BY AS MUCH AS 50% and save more than a decade in retirement years!

- Our Non-Qualified Plans are bank guaranteed and leveraged to increase future income potentially BY AS MUCH AS 60% to 100% or more.

- A MONEY-MAKING ALTERNATIVE is choosing to Put Less Money into your Tax-Deferred Qualified Plan, and using that Tax Deferred-Money, for our “Non-Qualified Optimized and Leveraged Retirement Bank Guaranteed Savings Plan” With a Tax-Free Maximized Income for Life or the No Collateral Hybrid Plan with None of the Risks Associated with Borrowing.

- By taking a smart, through approach to optimize retirement planning, you will have the opportunity to increase your standard of living, extend the longevity of your portfolio and leave a larger legacy.

- Don’t let your Qualified Plan become a Tax Burden!

- Create your own Secondary Personal Pension Plan as an Optimized and Leveraged Retirement Account that you can control and that allows tax-free distributions and has no IRS funding limitations and invest for inflation protection. All Qualified Plans are Deferred Taxable income.

HOW DOES THE SAVINGS USING SIMPLE MATH FOR AN IRA COMPARE?

As an example, assume your regular IRA has $1 million in assets. Assume the effective tax rate is 40% and you have an investment strategy that doubles your investment every 10 years. After a decade, the regular IRA doubles in value to $2 million. At a 40% tax rate times $2 million a tax of $800,000 goes to the IRS, leaving your IRA investment with $1.2 million after taxes. Compare: 401 K-Comparison To see how you can start out with more money and outperform an Employer Matching Contribution Plan, Roth, Cash Balance, Defined Benefit or a 401 (K), read “RETIRE BETTER THAN YOU LIVE TODAY” and “ARE YOU CURRENTLY SAVING ENOUGH?” sections on this page.

-

- The best time to plan a tree was 20 years go. The second best time is now * Chinese Proverb

- Also contact us to learn if your present QUALIFIED RETIREMENT PLAN is eligible for a Qualified Leveraged Strategy.

Cayman Capital’s expertise includes the option of applying a wide range of uncommon and little-known tax-reduction solutions, with a customer-specific design, for eligible individuals and qualified business entities.

Cayman Capital, Inc. provides Specialized Tax & Financial Planning and Business Tax Consultation not only for Medical Service Providers, but for all Eligible Individuals and for Owners of Business Entities and for employee key person retention and recruitment, over a Broad Spectrum of Different Industries.

See “TAX PLANNING & FINANCIAL SERVICES FOR BUSINESS & INDIVIDUALS” under “Why Choose Us”

Cayman Capital additionally offers various unique equity investment choices such as Buffered Investment Portfolios and Fixed Income Choices linked to Stock Market Index Gains with Guaranteed Loss Protections, as well investments uncorrelated to market performance.

See “SAFER PORTFOLIO MANAGEMENT & EQUITY INVESTMENTS”

CAPITAL GAINS 95% CASH OUT CAN BE YOUR MONEY IN YOUR BANK NOW

- Get in front of President Biden’s push for major hikes in Capital Gains Taxes. See the above heading: “CAPITAL GAINS TAX SURGERY” and then see IRC 453. Defer Capital Gains Tax for Decades & typically get 95% of the Full Sale Price as Tax-Free Cash Now. This is Cash for you to use with No Associated Restrictions or Conditions.

- Cayman Capital also specializes in Innovative Tax Solutions for Reducing the Impact of Capital Gains from separate income such as for Deferral of Capital Gains from Publicly Traded Stocks, see Deferred Sales Trust under the heading Capital Gains Tax Surgery, and see other choices of various other Capital Gains Tax Mitigating Income Distribution Strategies for Eligible Individuals and Qualified Business Entities.

WHY WE NEED TO PLAN DIFFERENTLY

Former head of the U.S. Fed, Alan Greenspan, put it simply: “Deficit spending is simply a scheme for the confiscation of wealth.” The last great inflation of 2008 wiped out 12.8 trillion dollars of wealth. US NATIONAL DEBT NOW IS OVER 31 TRILLION. That means every man, women, and child in America OWES almost $100,00. Without adjusting for inflation the Congressional Budget Office has projected the pandemic will cost the U.S. economy an additional $16 Trillion over the next 10 years.

Over the last year or so, the US government spent a total of over 6 trillion. This is more money than the U.S spent in World War 1, World War 11, and the Vietnam war….. Combined.

The fact that gas prices have recently gone up 55% is just one result of our current government printing dollars like monopoly money. Inflationary out of control debt depreciates purchasing power, and results in easily seen increasing prices, and is financed by noticeable increases in the taxation of business entities and individuals. Free money is not free. Remember the prior 1970’s inflationary fiasco unfortunately did last into the 1980’s. Then there was the great inflation of 2008. Unprecedented increasing exponential deficit spending, is now contributing significantly to a new and uncharted era of unbridled inflation.

The First Graph in the Link Below will show you what happens, when in a short and recent period of time, our money supply exploded to an incredible 378%.

Consider strategies and investments that weather the increases in tax rates by preserving a percentage of your assets so they can prosper in a Tax-Free World. Protect Against Inflation and the Future Tax Increases that will be affecting your Earned Income, and the diminished purchasing power of future distributions, from your Tax Deferred Qualified Retirement Accounts. There is a high probability significant negative taxation regulations for the taxpayer may begin to be notable when TCJA ends in 2025. CLICK ON LINK: https://seekingalpha.com/article/4426754-investing-with-inflation-150-years-data

Tax increases potentially also decrease the longevity of existing qualified retirement plans. Are you prepared to lose 50-60% of your retirement income to taxes? Here are three things that we can do for our clients who can qualify for a customized planning strategy for Tax-Free Income:

- Safeguard from inflation.

- Protect from Crashing stocks.

- Ensure that your Retirement Leveraged Savings Plan will always have value you can rely upon.

The three primary choices for Tax-Free Income: Roth Qualifed Plans, Municipal Bonds and Index Universal Life Insurance.

Cayman Capital specializes in the application of customized Structured Financial Modeling, as applied to Leveraged Savings Plans for Individualized Tax Compliant Strategies, that maximizes and protects income, while also protecting more of your estate from Taxation. This is what makes us unique. Leveraged Savings Plans increase income and net worth without the tax.

RETIRE BETTER THAN YOU LIVE TODAY

Cayman Capital, Inc. offers Stock Market and Managed Portfolio Investment Choices from various prestigious market makers such as Goldman Sachs, RBC etc.

We also offer managed Buffered Stock Market Portfolios that can guarantee 100% protection from loss of principal. We offer Dividend Portfolios, Fixed Income, Growth and Stable Value Portfolios, ETF’s etc. For a More Complete List See Portfolio Safety & Equity Investments under the Heading ”STRATEGIES.” We also offer Leveraged Savings Plans underwritten by major insurance carriers.

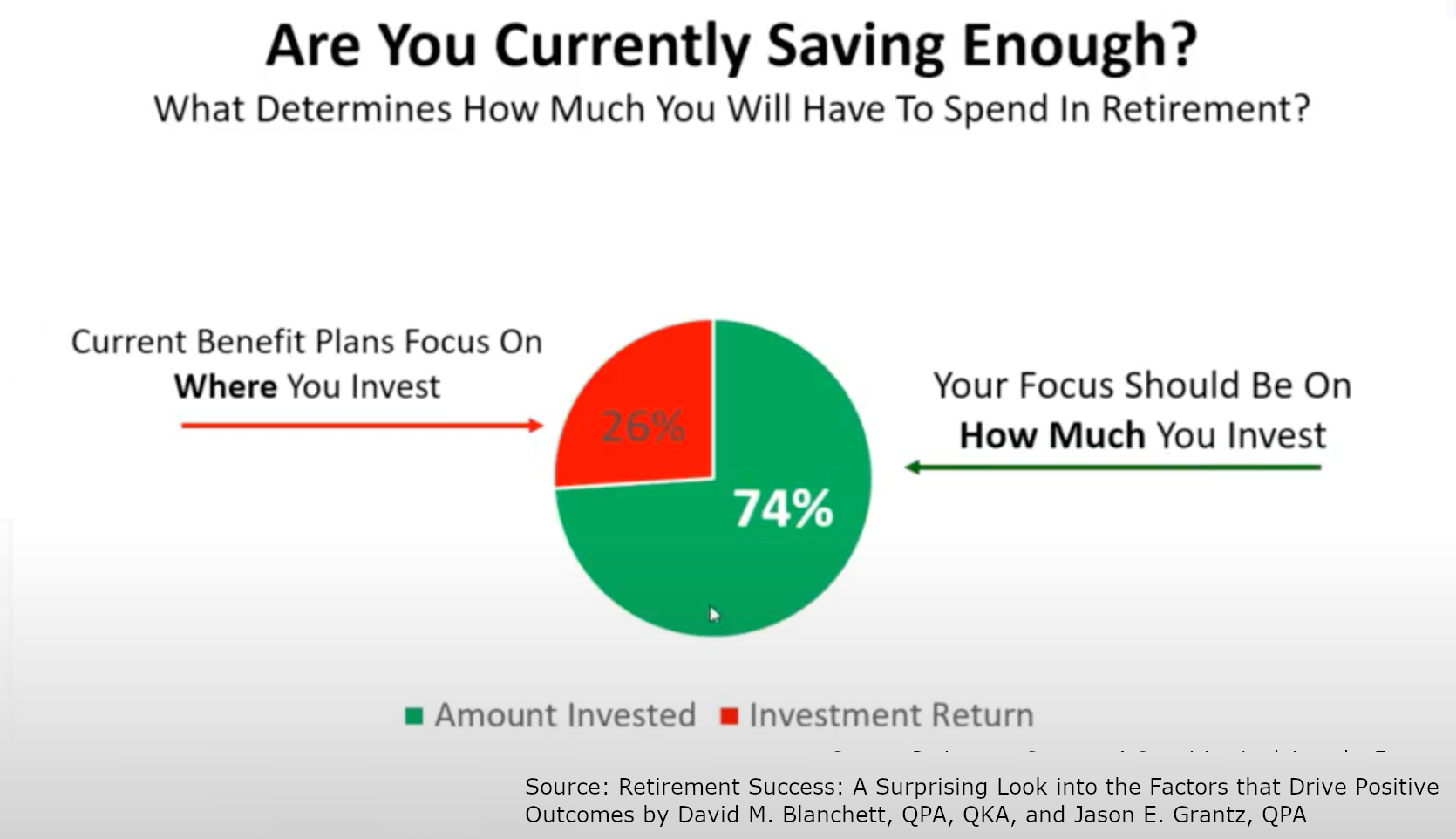

See ”ARE YOU CURRENTLY SAVING ENOUGH?” pie chart below.

A WORD ABOUT INSURANCE AS ONE OF THE WORLD’S SAFEST ASSETS AND ISN’T LEVERAGE RISKY?

Indexed life insurance. This asset is guaranteed not to lose principal. This is one reason why banks can loan money at their best preferred rate (Tier 1) for insurance premiums to pay for leverage. Please click on the following article written by two Tax and Estate Planning Attorneys. Insurance-The-Powerful-And-Despised-Tax-Shelter.pdf

Leverage is only as good as the asset being leveraged. Can Stocks and Real Estate claim to be guaranteed to not go down in value ? Leveraging stocks or real estate can be devastating. Cash value life insurance has reliably paid dividends since before the civil war. Cash value life insurance can deliver amplified earnings for Tax-Free future distribution by maximizing the cash value with leverage that has security. We use some of the financial worlds safest tools to work for you with out our hybrid policies. Only a Bond or CD can compare in Safety and Predictability. However, unlike bonds, CD’s or your 401 (k) money can be available when you need it.

A 401K with an employer matching plan is using leverage. The mortgage on your house is a routine and traditionally accepted use of leverage to purchase a bigger home.

The client is also borrowing other peoples money from the bank at a lower rate and then using it to earn a higher rate. (This is not the case when you borrow money from the bank for your mortgage) This arbitrage is characteristic of a well designed premium financed policy. Leverage is using somebody else’s money to make money.

Similarly, there is a guarantee of no loss of principal and the premium financed insurance premiums will typically increase your retirement savings overtime, by at last three times more money, than if you had just used your own money to pay the premiums.

Therefore, there is considerably more money available for retirement or as supplemental income from a savings plan that offers the premium finance strategy. More money that can allow for a better future lifestyle. Wealthy individuals and successful business entrepreneurs have been using other peoples money in this way for decades to become prosperous.

With No Collateral Plans the Client can be totally protected from all risks associated with borrowing.

The type of Tax-Free Income Plan best for the client still will depend on the clients individual circumstances and objectives. Cayman Capital will make recommendations to help you choose the best customized plan for your present and future needs.

When you become our client it is for life, because as time goes on needs and priorities change for everyone.

The Significantly Increased Cash Value of the Premium Financed Savings Account Guarantees the Bank Loans for the Insurance Premiums so No Collateral is needed. The Savings Account can therefore Provide a Future Larger Reliable Tax-Free Income Stream.

The bank depending on the choice of strategies, is either paid back by the cash value or a death benefit. In either case because of premiums being financed by the bank, there is a substantial multiplication of the amount cash in the saving account which can either be tax-free income or can continue to be maximized.

After the bank is paid back, because of the initial premium financing and continuing financing, there is still a very substantial amount of cash value in the savings account for either continued tax-free income, or as cash for a larger legacy to the beneficiary.

Tax-Free Income Plan One for eligible individuals and business entitles, is a current state-of-the art premium or cash value finance offering which also combines benefits of an innovative highly advanced design.

Plan One is an Index Universal Life Insurance that may also use a Whole Life Insurance Product, providing Extra Safety and Dependability for the Greater Cash Value Accumulation, when indicated by the clients circumstances and market conditions.

With Tax-Free Income Plan One the Bank may help fund the Premiums for the life of the policy. Cost can be eliminated or neutralized and money can be leveraged 3 to 5 times more. The Bank can also leverage the cash value of the policy instead of the premium.

With the Kai-Zen IUL No-Collateral design the client is protected from all risks associated with borrowing. How does a leveraged Indexed Universal Life Insurance (IUL) like Kai-Zen Benefit From the Present High Interest Inflationary Environment. Using the Kai-Zen IUL as an example please see this brief 2-3 minute video: https://www.youtube.com/watch?v=Ef-TBudC8qY

Plan Two (Kai- Zen) No Collateral Designs will typically receive a minimum future return of 60%-100%. Future returns can also be significantly greater as the design depends on the clients individual particulars. The Bank will contribute funding Premiums for the policy for 15 years.

KAI-ZEN-STRATEGY AVOIDS NEGATIVE FACTORS ASSOCIATED WITH TODAYS HIGH INFLATION AND HIGH INTEREST ENVIRONMENT.

Tax-Free Income Plan Three are the Collateralized Designs and will typically return 200%-300%. The Bank will typically fund the Premiums for the policy for 7 -10 years. In some cases the lender may request additional collateral be posted to secure the loan.

Plan Two and Plan Three are excellent choices depending on the clients circumstances and similar Plans are available from thousands of financial and wealth management firms. Our premier plan “Tax-Free Income Strategy Plan One” is a unique design that has been offered to eligible individuals for the past 10 years and is selectively available to wealth management firms.

HOW PREMUIM FINANCING WORKS CONTINUED:

The banks we work with consider their premium financing loans to be “Tier One Loans” which means the loan rate is a qualified preferred rate defined as the lowest and best possible interest rate available.

- The bank is able to offer very low interest rates during the duration of the note as the insurance policy is a more secure asset to the lender than a 15 year mortgage. The housing market can have corrections that plummet property values.

The bank is writing the check to the insurance carrier. The client never sees the check. Neither Corporate or Personal Guarantees are Required.

- If the Client Choses to Pay a Portion of the Interest on the Bank Loan this will Significantly Increase Income and the Legacy. Depending on the client’s objectives and individual circumstances the INTEREST for PREMIUM FINANCING can a deductible business expense.

Premium Financed Insurance with Bank Guaranteed Savings Plans are acknowledged as one of the Best and Most Tax-Efficient Ways to Save for Retirement.

Protecting your income and savings with premium financed insurance can allow you to maintain your current lifestyle through retirement. Your retirement will cost an average of 6 times more than your house. Do you have enough saved?

- Premium Financing applies to many different circumstances. Good marketing motivates most of us to focus our retirement accounts primarily with an asset management approach.

The prestigious American Society of Pension Professionals & Actuaries have established that 74% of successful retirement accounts are due to starting out with more money, and only 26% are successful due to a rate of return earned from asset management. Would you prefer to earn 10% on $100,000 or 5% on $400.000?

If you currently earn $250,000 per year you will need around $6,500,00 saved for retirement to maintain your current lifestyle.

Therefore, starting out with more money increases your chances of success by 3 x 1. Premium Financed Leveraged Savings Accounts typically will deliver at least 3 times more cash in your account. Click link for research results American Society of Pension Professionals & Actuaries ASPPA Journal pdf

Premium Financing means you will be initially starting out with more money and maintaining more money in your account. This is so you can potentially also end up with more money as income for a better retirement lifestyle.

Another very simple way of saying this is that bringing additional money to the table with the same acceptable rate of return will result in having more money. Having more money to take advantage of in your account will maximize your income stream.

- For instance, you are using leveraging when you have a mortgage from the bank on the house, so you could buy a better house with less money as a down payment. The mortgage company requires that you take out insurance so there is a guarantee they will get paid back.

- In this case the guarantee to pay the bank back for financing your account is an insurance policy, and you can choose not to pay any monthly interest payments as the bank is making the payments for your monthly insurance premiums, and you do not have to make any payments toward the principal.

- Keep the use of your own money and its return.

- Keep Cash Flow for New Opportunities.

- Money is leveraged without the following risks. This unique insurance design has a Zero floor that guarantees protection against any loss of principal or any loses from the stock market. This policy only participates in the upside potential of the market. Eliminating the possibility of loss also significantly increases rate of return.

- The client benefits from an enhanced tax-free future income based on the cash value of the insurance policy which is typically increased 200%-300% with the Collateralized design.

- The death benefit can pay back the loan, and is an increasing amount to cover the interest portion of the loan, and is always more than the loan. Net of the loan we typically see a significant legacy for the beneficiary.

- The mathematical expressions designed for the policy’s’ compounding strategy of the cash value, is only one of the arbitrages behind correctly designed premium financing.

- The cash value in the insurance policy compounds faster than the loan rate, and because of this arbitrage, collateral is released in only a few years, when the cash value of the policy is the same as the collateral. This is called the crossover. The crossover is different for each person. Until there is the crossover the client is required to pledge collateral.

- ”TAX-FREE INCOME STRATEGY PLAN ONE & PLAN TWO” examines the Benefits of Hybrid Financing with NO COLLATERAL and NO PERSONAL GUARANTEES REQUIRED Designs. The client is protected from all risks associated with borrowing. Also PLEASE NOTE THERE IS ALSO A No Collateral Option with PLAN THREE.

- “TAX-FREE INCOME STRATEGY PLAN THREE” also covers this in more detail and reviews the advantages of a premium finance design with a more traditional approach that REQUIRES COLLATERAL.

- Cayman Capital will make recommendations to help you choose the best plan for your circumstances and individualized wealth management needs. Click Here for a Sample Comparison of the 401 (K) vs Premium Financed Retirement Savings Plan.

- Consider the Optimized Retirement Bank Guaranteed Leveraged Savings Plan Alternatives Before Max Funding Your Qualified Plans.

- Don’t let your Qualified Plan become a Tax Burden!

- All Qualified Plans are Tax-Deferred Taxable Income. If you have a Self-Directed Qualified Plan consider Dr. Noss Professional Tax Expertise and Experience as an Investment Advisor who can Proficiently Optimize your Tax-Deferred Qualified Plan.

- Please also consider creating your own Secondary Personal Pension Plan as an Optimized and Leveraged Bank Guaranteed Supplemental Retirement Account that you can control and that allows tax-free distributions and that also has no IRS funding limitations.

- Serving Clients all over the United States by offering virtual meetings.

- Compare a courtesy financial services premium finance designed illustration for yourself or your company, and see benefits significantly better than employee stock options, RSU’s, or even bonuses, which are taxed at 22%.

- Also see if your present qualified retirement plan is eligible for a Qualified Leveraged Strategy.

- Consider taking advantage of the free evaluation and free virtual consultation offered.

FINANCIAL INCOME MULTIPLIER STRATEGIES

DISCLOSURES

Cayman Capital offers individualized custom Insurance Products for Estate Planning including Charitable Lead Trust, Charitable Remainder Trust, Charitable Remainder Unitrust, Gift of Life Insurance, or combining Retirement Planning and Charitable Giving.

To the knowledgeable tax professional, life insurance as an asset class is a versatile cornerstone of estate planning, and many other tax planning strategies, offering everything from retirement income and diversification of investment value, to funding a charitable annuity trust, special needs trust, or facilitating the profitable transfer of business ownership. Life-Insurance-The-Powerful-And-Despised-Tax-Shelter.pdf

Tax laws relating to these insurance strategies are complex.

- The advantage of Financial Engineering is often applied when a proprietary or non-proprietary premium finance life insurance design needs a framework for compliance as a tax benefit for the client or for a trust or estate plan.

- Financial Engineering is the application of mathematical techniques to solve financial problems as well as to devise new and tax compliant customized innovative financial products.

- Financed insurance INCOME MULTIPLER DESIGNS are a very specialized area of expertise. It’s just math not magic.

- Enhanced Income Multiplier Designs for a Maximized Savings Plan can typically boost your future retirement or supplemental cash accumulation, by at least triple the amount of money in the account than if the premiums were not leveraged for accelerated growth.

- Cases that lack the proper customized design appropriate for the needs and suitability of the client typically do not have the ability to survive and many are not serviced to achieve competitive rates.

- Policies must be designed to apply a customized financed insurance leveraging formula prudently and appropriately.

- Insurance Structured Tax Strategies are Regulated by IRS Codes.

- Premium finance insurance enhanced income designs require strict adherence to many tax rules. Designs not in compliance or are vague and lacking clearly defined details can be subject to IRS audit and may lose all tax benefits.

- Premium financing is a complex insurance transaction, and when implemented in a proper manner, can be an impressive tool as a specialized tax strategy that allows the client to have more money to invest while presenting for the client a tax-free plan for future income.

- In some cases, income may be tax-deferred such as with structured finance design solutions for Capital Gains Strategies.

- Cayman Capital has partnered with certain highly talented financial services companies that have considerable specialized expertise in applying optimum premium finance loan parameters, with their proprietary and non-proprietary customized financial engineering designs.

- Cayman Capital will meticulously analyze all requested financially engineered premium finance designs before presenting to the client.

- Customized safer enhanced income premium financed designs, with the confidence of tax compliance, prepared for our clients’ particular circumstances and overall personal financial plan, is what Makes Us Unique.

We strive to choose the case design with the best beneficial impact for the client. We evaluate for tax compliance and for tax consequences and the client’s suitability as a criterion for the best strategy design that would be the most appropriate fit. The most appropriate customized case design is typically optimized to present Leveraged Savings with accelerated compounding, to produce the Maximum Growth required to generate a maximized TAX-FREE INCOME for life. Enhanced income multipliers average 75% but can be less or more, dependent on the best tax-advantaged design for the clients’ individualized circumstances. Click on: Are You Saving Enough?

COMPLIMENTARY EVALUATION & EXPECTATIONS

Proposed designs are evaluated by our firm based on the above Disclosures for Financed Insurance and other factors. Virtually every case design analyzed is different and is designed for compliance and for the clients’ needs. No one size fits all.

Since we are not captive to any one individual company there is no hidden bias based on a choice comparison for the client. This is so we can evaluate and analyze customized case designs from these competing financial services companies, and choose the appropriate company and case design with the most advantages and best fit pertaining to that client’s individual suitability and particular need.

- The banks we work with consider their premium financing loans to be “Tier One Loans” which means the loan rate is a qualified preferred rate defined as the lowest and best possible interest rate available.

- The bank is able to offer very low interest rates during the duration of the note as the insurance policy is a more secure asset to the lender than a 15-year mortgage. The housing market can have corrections that plummet property values.

- Companies that Require Collateral may require a Minimum Net Worth and Minimum Income. Eligibility depends on the company and the individuals’ financial circumstances. In some cases, additional collateral may be required. CORPORATE or PERSONAL GUARANTEES are NORMALLY NOT REQUIRED. Almost all have tax-free rather than tax-deferred design choices.

- Other Companies Do Not Require Collateral. Loans can be structured so the Savings Plan for the individual client or the company is Permanently the Only and Sole Collateral guaranteeing the bank loan. Therefore, the client is protected from all risks associated with borrowing. These designs are a unique combination of bank financing and insurance premium funding called Hybrid Financing. No signing of any loan documents is needed from the client. In this case, neither an employer nor employee or other eligible designated clients, are not in any way connected or obligated by the bank loan. No corporate or personal guarantees or financial underwriting is required with HYBRID FINANCING. A minimum income of $100,000 or a client with an appropriate net worth will be considered.

- Our Firm does a very careful and comprehensive evaluation considering the needs and circumstances of each client so an informed decision about their individual strategy choices can be relied upon.

401(K) & IRA PLAN SERVICES

Cayman Capital also provides fully customizable cutting-edge 401(K) & IRA Plans. CalSavers requires every employer with more than 5 employees doing business in California to offer a Qualified Plan. We can provide everything needed for your firm pertaining to a preferred Qualified Plan and a selection of Non-Qualified Plans.

Contact us today for your complementary individual retirement planning session, and compare our low fees with the current administration cost of your present plan.

See the comparison of collateral or no collateral Non-Qualified Premium Financed Savings Plans compared to IRA and 401 (K). Click on 401 K-Comparison. Consider putting the MINIMUM amount of Deferred Taxable Money into your Qualified Plan, and a MAXIMUM amount of Savings into a Non-Qualified Leveraged Savings Account. This choice will allow you to enjoy a substantially greater supplemental Tax-Free Retirement Income.

Nearly every employer that sponsors a retirement plan potentially has personal liability for excessive fees….. For further reading: What Makes a Plan the Target of Excessive Fee Litigation?

See above heading “TAX RESOLUTION” if you need representation because the IRS disqualified your Retirement Plan.