HOW IT WORKS

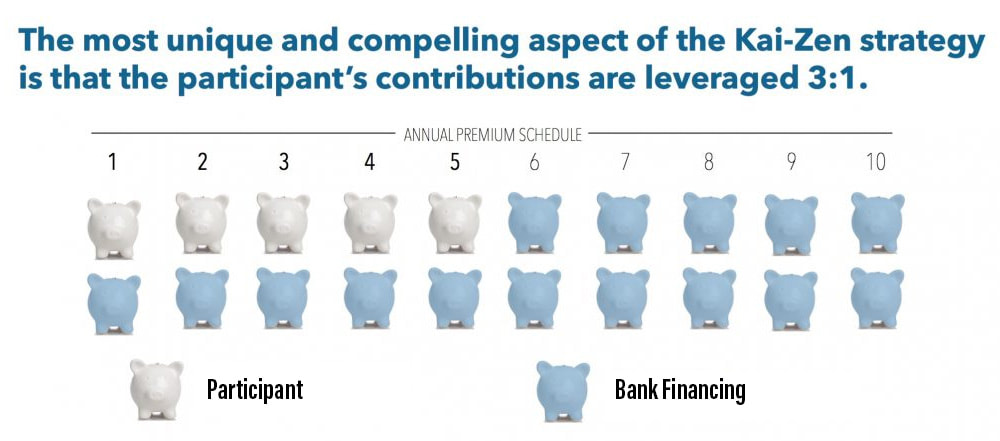

The Kai-Zen* strategy is not complicated. Premiums are jointly funded by bank financing and the individual client or employer. The bank financing provides the majority of the total contribution to a leveraged savings plan, and the life insurance policy itself is the full security for the loan.

This strategy is specifically designed so that the participant is not required to go through financial underwriting or sign any loan documents. No personal or corporate guarantees or collateral is ever required. As an additional protection, Kai-Zen’s structure is also set up to protect your benefits in the event of employer bankruptcy. Kai-Zen is defined as hybrid financing and is not the same as traditional premium financing. Kai-Zen is the power of conservative leveraging with hybrid financing.

Years 1-5

During the first 5 years, with this unique design the client contributes their portion of 5 payments and the lender finances the additional 5 matching premiums into the insurance policy for the future retirement income.

A client also may make one larger initial payment and the lender will match it.

Most retirement plans and insurance policies require funding to typically continue for decades.

Years 6-10

After year 5, the clients obligation is completed and the lender now makes all the remaining premium payments. Clients money has been leveraged 3 x 1 by the bank. The client now has a larger amount of money in the policy from the 75% of bank guaranteed leveraging. This is for the purpose of enhanced compounding of the cash value of the account.

Years 11-15

The policy is continuing to compound the cash value and no additional funding is required by the client or by the bank. During this time, the policy has the potential for significantly greater accumulation and more income performance resulting in more value.

This provides for an improved retirement income due to initially starting with a larger amount of money from the leveraged savings account, combined with compounding the rate of return of the cash value within the policy.

The unique mathematical structure of the insurance plan contributes to the compounding rate within the policy. The bank is able to offer very low interest rates during the duration of the note as the policy is a more secure asset to the lender than a 15 year mortgage. The housing market can have corrections that plummet property values.

The lender’s note is projected to be satisfied approximately by the end of the 15th year and at that time the client may choose to draw an income. Client also has the option of allowing the cash value to continue compounding and then draw an even larger income at a later time of his or her choosing and also produce a greater legacy.

Kai-Zen is the power of conservative safer leveraging with “HYBRID FINANCING.”

Years 16 and beyond

Policies potential cash value continues the leveraged accumulation to support additional enhanced tax-free retirement income distributions to the client every month for decades to facilitate a better lifestyle.