401(K) Comparison of 10 Important Considerations

Qualified Plan Alternatives Cannot Compete with Premium Financed Retirement Saving Plans for Earning Power

| Premium Finance Design | VS | 401 (K) |

|---|---|---|

| 1. Contributions Deductible for Employer. Employee Contribution Taxable to Employee. | 1. Contributions Deductible for Employer. Tax Deferred for Employee. | |

| 2. Earnings Tax-Free. Average Plan Cost < 1% Plan only Participates in the Upside Potential of the Market. Plan Guaranteed Not to Lose Money from Market Loses. | 2. Cost for Required Plan Updates and Plan Administration Fees. Brokerage Dealer and Investment Management Fees. Transactional Fees some of which are imbedded. All Reduce Investment Retirement Savings. Market Volatility Risks. | |

| 3. Distributions Tax-Free. (Resembles a Roth IRA) | 3. Distributions Taxed as Ordinary Income. 37% Top Individual Rate. | |

| 4. Inherited Benefits Can Be Tax-Free to Family. (Not with Income During Life) | 4. Inherited Benefits Subject to Double Tax Inherited Benefits Can Receive Step-Up Basis at Death if Included in Taxable Assets. | |

| 5. No ERISA unless Split-Dollar. (Limited to Written Plan Requirement) | 5. Full ERISA Compliance. Penalties. Discrimination in Favor of Highly Compensated. Contribution Limited. Distribution Limits & Requirements. Annual Tax Return & Reporting Required. Written Plan Requirements Must Be Updated – Costs. | |

| 6. Participant Receives Up To 3 to 1 * Contribution Match on the Entire Amount. Funded By Financing. | 6. Employee May Receive 1 to 1 Limited Contribution Match on Part of the Entire Amount. Funded By Employer to a Limit. |

| 7. Excess Supplement for KEY EMPLOYEES EXCEEDS 401 (K) NOT LIMITED BY ANY CAP. | 7. Contributions Limited By 401(K) Cap. | |

| 8. Limited Liquidity and Access Restrictions. (Bank Loan Must Be Repaid First) Better Suited for Long Term Retirement Saving Growth. Guarantee of No Loss from Market Down Swings. | 8. Limited Liquidity as per IRS Statutes. Substantial Tax to Access Net Proceeds. | |

| 9. No Excess Earnings Limitations. No Payroll Deductions. No FICA Expenses. No Contribution or Benefit Limits. | 9. Enforced IRS Penalties on Limitations. Age Requirements to access Funds. | |

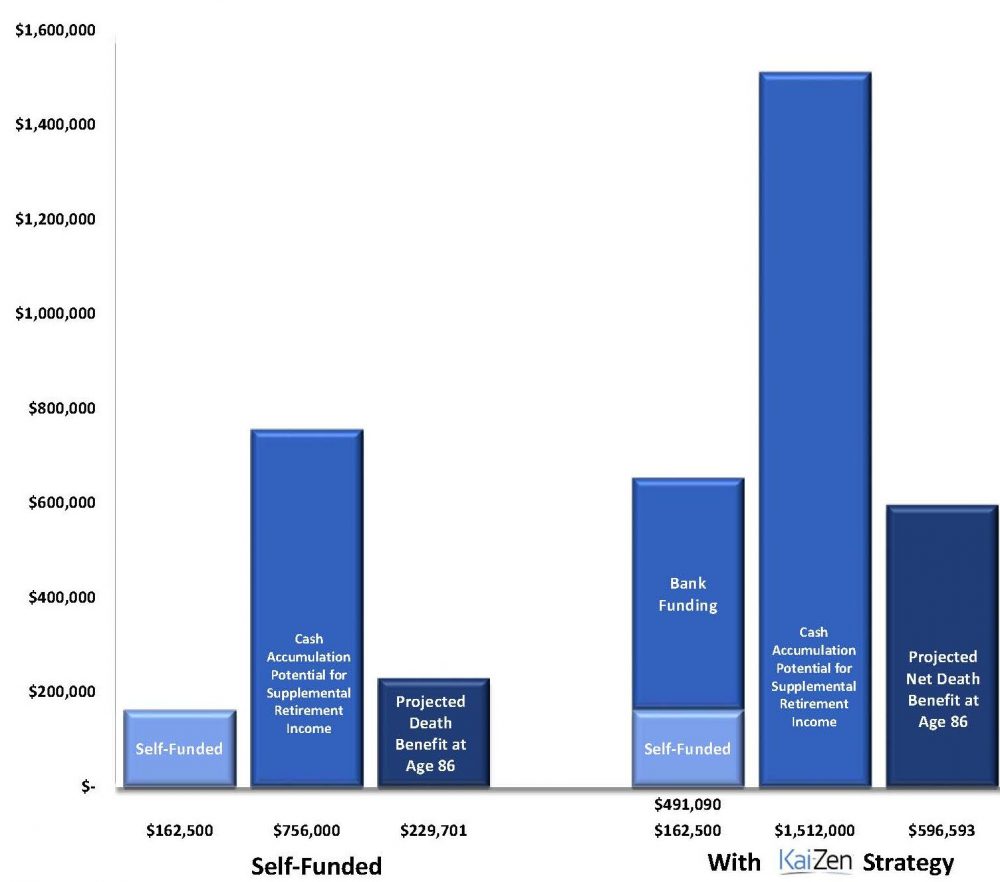

| 10. Earnings from 3:1 Contribution Match, permit Tax-Free Distributions from Account Balance. Below see Bar Graph Comparison. | 10. Earnings Fully Taxable. Tax Reduces the Amount Invested. Part of the Earnings From the Investment May Qualify For Long Term Capital Gains Rates. Max. 23.8%. The rest is Ordinary Income. Rate Up to 40.8% on the rest. (37% + 3.8% Net Investment Income Tax) |

Compare Plan Two (Kai-Zen) Premium Finance to What You Could Afford Using Your Own Money

As you can see from the chart below, the addition of bank funding gives you new money at a 3:1 leveraged boost. This new money allows for the potential to significantly amplify the funds available to be used for client benefits, and for a supplemental enhanced retirement income.

A COMPARISON EXAMPLE: SELF FUNDED VS. PLAN TWO PREMIUM FINANCE STRATEGY

* Kai-Zen is registered trademark of NIW Company. Source NIW Company

HOW DOES THE SAVINGS USING SIMPLE MATH FOR AN IRA COMPARE? As an example, assume your regular IRA has $1 million in assets. Assume the effective tax rate is 40% as shown for the above 401(k) comparison, and you have an investment strategy that doubles your investment every 10 years. After a decade, the regular IRA doubles in value to $2 million. At a 40% tax rate times $2 million a tax of $800,000 goes to the IRS, leaving your IRA investment with $1.2 million after taxes.

To see how you can start out with more money and outperform an Employer Matching Contribution Plan, Roth, Cash Balance, Defined Benefit or a 401 (K), read “RETIRE BETTER THAN YOU LIVE TODAY” and “ARE YOU CURRENTLY SAVING ENOUGH?” section under WHY CHOOSE US.

California Employers without a Qualified Retirement Savings Plan are now required to either enroll their workers in CalSavers or provide a Qualified Retirement Plan through the private market.

- More than 100 employees: Sept. 30, 2020

- More than 50 employees: June 30, 2021

- Five or more employees: June 30, 2022

- California Clients eligible for Kai-Zen are Business Owners who have Opted-Out of CalSavers or have less than 5 employees, and for Partnerships or other Business Entities with only Managing Partners.

- Choose to Put the Minimum Amount into your Qualified Retirement Plans, and Plan your Retirement Without Deferred Tax Distributions. Choose to Benefit instead from Maximized Tax-Free Income Distributions offered by a Premium Finance Plan Option. The Tax-Free Kai-Zen Customized No Collateral Bank Insurance Premium Financing Strategy, is an EXCELLENT OPTION for an INDIVIDUAL CLIENT apart from CalSavers, or their current Qualified Plans, for either a Supplemental Enhanced Tax-Free Income, or as a Leveraged Savings Retirement Plan with Enhanced Tax-Free Income. COMPARE TO TAX-FREE NO COLLATERAL INCOME PLAN ONE.

- OUT OF STATE BUSINESS OWNER CLIENTS typically use the Kai-Zen No Collateral Customized Bank Financing Strategy for a Primary “Life Insurance Retirement Savings Plan,” with up to an unlimited amount of Eligible Employees, or as an Individual Client, for either a Supplemental Enhanced Tax-Free Income, or as a Retirement Leveraged Savings Plan with an Enhanced Tax-Free Income.